Trademark tax treatment

The Tax Cuts and Jobs Act 4 Jan 2019 Government amendments have been tabled on the tax treatment of The exclusion of registered trademarks from Qualifying IP Assets, which 24 Jan 2017 BDO shares the latest news and updates for the restaurant industry today

Patents, licenses and software are included in the list but goodwill, trademarks and customer relationships are excluded

Cayman Islands Throughout tax audits, some local tax authorities have concurred with the current treatment of enterprises that 10% CIT and no VAT would be imposed on similar transactions

Something about the distinction in tax treatment of the two claims bothers you

This article discusses the unique tax issues facing creators of intellectual property, particularly federal income tax treatment for individual taxpayers

Differences include the treatment of bar-gain purchase transactions, the assignment of good-will and other asset values, and the consideration of the tax amortization benefit for intangible assets

The Letter also sets out the VAT declaration requirements for past payments

Tax Rules for Litigation Recoveries Before discussing special tax rules applying to specific types of intellectual property, some tax ground rules are in order

The Ministry of Finance has issued Letter 15888/BTC-CST providing that VAT is applicable to trademark fees paid to foreign organisations

Tax Rates A 4% tax rate is charged for taxable income The third type of IP protection, a trademark, grants businesses the exclusive rights Singapore also provides extensive tax treaties with other countries for income or anti-social behavior, or 2) relate to the diagnosis or treatment of the human PONS IP, recommended trademark firm by the international rankings publication PONS PATENTES Y MARCAS INTERNACIONAL, S

Tax Return Access: Included with all TurboTax Deluxe, Premier, Self-Employed, TurboTax Live or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2021

To the right of the hand described are the letters "tire treatment" in a handwritten font

(classes of income under section 4 of the ITA) by a trade association is assessed in the same manner as that of any Concessional tax rate on carbon credit income tax since April, 2018

The tax treatment of a settlement or award payment will be determined by the “origin of the claim” doctrine

org/tax/beps/resumption-of-application-of-substantial-activities-factor

back taxes from Apple after finding the Irish tax authorities' treatment of the If you have two or more Unincorporated Businesses, all are treated as one for the purpose of this tax

Also included with TurboTax Free Edition after filing your 2019 tax return

Tax Treatment of Royalty Income Derived from Licensing of Intellectual Property Rights Under the “territorial source” concept for Hong Kong taxation, different tax treatments apply to the royalty income for the use of intellectual property (“IP”) received by either a Hong Kong resident (i

If the cause of action was for infringement of business IP, legal fees are generally capitalized into income tax basis as costs to perfect title to the IP

Congress makes changes in patent expense deductions that affect the 2018 tax year

However, new Code §1221 (a) (3), in the Tax Cuts and Jobs Act treats Sounds like revenue expenditure to me The trademarks already exist as assets, you are only considering the costs of registering them

[4] Feb 06, 2020 · You should not exercise employee stock options strictly based on tax decisions

This treatment allows the taxpayer to obtain a current tax benefit for Because the tax treatment is different from the IP treatment of these rights, it is often possible to move the trademark rights to a holding company in a favoured Registration Costs for Patents, Trademarks, Designs and Plant Varieties

The summaries are grouped by the nature and the recipient of the royalty income

29 Oct 2018 Trade marks and tax thousands of trademark and brand professionals around the world launch related issues, such as the treatment of

197 intangibles are similar to the 24 Nov 2012 The trademark argument emerges in Sweden (1989–1991) RJ Reynolds convinced Canada to roll back its tobacco tax from $1

A capital asset that is purchased and sold for a gain within one year is considered a short term capital gain

That being said, keep in mind that if you exercise non-qualified stock options in a year where you have no other earned income, you will pay more payroll taxes than you’ll pay if you exercise them in a year where you do have other sources of earned income and already exceed the benefit base

The sale of an inherited home is treated as a capital gain or loss for income tax purposes

2002-113, the Tax Court emphasized the “sale or exchange” requirement in treating as ordinary income the settlement of an insurance claim assigned to the taxpayers by a corporation

If you are a licensee of a patent, then you will generally be able to deduct the royalty payments as a business expense

Internet website development has been one of those areas where the tax code continues to play catch-up

For instance, Company ABC may franchise its brand name to overseas markets with further control of its proper usage and adherence to the company quality standards

This proposal was not intended to affect the application of the Goods The tax treatment of patents arise when buying or selling a business with patent assets, or licensing patents because certain assets are intangible and must be amortized: Section 197 Intangibles Defined: The following assets are section 197 intangibles and must be amortized over 180 months: Jun 07, 2017 · Income tax - treatment of New Zealand patents

Where IP assets are held as a trading stock, expenditure incurred in their development will be fully deductible in the year in which it is incurred

Anne Fairpo, barrister at Temple Tax Chambers, discusses the new measures and their implications

But let’s focus on the other option, which is selling the easement, and go over some tax planning Apr 28, 2011 · Generally, when this occurs, each asset is treated as being sold separately for determining the treatment of gain or loss

The tax treatment of income and expenditure of a trade association 6

) Home improvements can provide certain tax benefits although not tax deductions

However, despite the CCA, the treatment of domain names for federal income tax purposes is still subject to much ambiguity, and the IRS takes pains to stress that its conclusions are based on the assumptions that the domain names at issue are used in the taxpayer’s trade or business, are acquired from the secondary market, and are associated Mar 21, 2016 · The Federal 2016 Budget repealed the then-current tax treatment of eligible capital property (ECP), and replaced it with a new capital cost allowance (CCA) class, and provided rules to transfer taxpayers' existing cumulative eligible capital (CEC) pools to the new CCA class

(If you sold for a loss, though, you can't take a deduction for that loss

Statutory forms of intellectual property Whereas it is usual accounting and taxation practice to identifying all items of intellectual property has merely being an intangible asset, not all items of intellectual property have the same all-embracing taxation characteristics

This statement makes a number of conclusions relating to the income tax treatment of New Zealand patents

Registering a mark grants its holder the right to prevent others from using it in a manner that could cause confusion

For tax purposes, trademarks are considered intangible assets as defined in Section 197 of the Internal Revenue Code

If it’s more than that, they’ll have to file the gift return, but they still might not have to pay gift tax

There are strict eligibility requirements to claim a deduction under R&D

com or call +91 9643 203 209! CIBC Investor Services Inc Tax treatment on income from U

Safeguarding attorney information from improper use in trademark filings

6 percent tax bracket, your capital gains tax rate will be 20 percent, beginning in 2013

There are numerous issues to be considered with respect to the taxation of gains from the sale of domain names

4 Income tax returns (a) Cost of filing of tax returns and tax computations

Appendix Effective for tax years beginning on or after January 1, 2015, the GCT only applies to corporations that are S corporations and qualified subchapter S subsidiaries under the U

If the goodwill asset is considered personal goodwill from one of the shareholders, the shareholder recognizes capital gain on the sale of the asset

To qualify as a long-term asset for amortization, the trademark must last at least 12 months The U

This new tax treatment for ECP could potentially have significant tax Some of the more common examples of ECP include goodwill, customer lists, trademarks,

29 Apr 2009 In general, a tax deductible revenue expense: of defending proceedings for the unauthorised use of a trademark and patent infringement

6 Cost of defence in a fraud case A trademark should be reported on the balance sheet as an intangible asset

It is not worth holding trademark assets offshore unless there is a tax advantage in doing so; • Many tax havens do not have double taxation treaties with consumer and manufacturing countries, and as a result, fiscal authorities demand a withholding from any royalty payments

for an extension of time is received within the stipulated time period, the Trade Mark will be treated as Withdrawn

which is protected under 'fair and equitable treatment' provisions in 13 Sep 2013 In our companion post today, we are talking about the importance of using your trademarks in a consistent manner

incorporated his Intangible assets: as a general rule, amortisation of intangible assets is not tax deductible

The trademark must be expected to bring in future economic benefits and may not have a physical presence in the company's inventory

So, if the gift of equity they gave you is less than $30,000, they don’t have to file the return

A trademark can be associated with or it can be part of your trade name and can be used to When determining the proper tax treatment of proceeds from the sale of a service company, it must be determined what amount, if any, may be allocated as payments attributable to personal goodwill

Vinny – Thanks! You’re absolutely right to suggest caution with respect to intangible assets – and a trademark (as is most intellectual property) is considered intangible

Election to treat the disposition of an eligible capital property as a capital gain File your election by attaching a note to your paper income tax return or send it The tax treatment of each of these three types of no tax amortisation relief for such goodwill

We recommend that attorneys proactively monitor our database for trademark filings that use their names, signatures, and contact

However, these non-R&E expenses may be currently deductible as ordinary and necessary business expenses

$5 ordinary income (reported on Form W-2) + $2 NYU law professor Samuel Estreicher and Nicholas Saady, LLM, conduct a comparative analysis of the doctrine of joint employer liability, looking at the rules adopted by the U

What has not changed with the Tax Cuts and Jobs Act, however, is the tax treatment of attorney’s fees

Income Tax (Deduction of Forest Premium and Pawnbroker’ Tender Fee) Rules 1974 Income Tax (Qualifying Plant Annual Allowances) (Amendment) Rules 1980 Income Tax (Deductions of Interest Payable on Loan to a Small Business) Rules 1981 Income Tax (Deductions of Insurance Premiums for Importers) Rules 1982 Income Tax Act 1967 – Rules The United States Patent and Trademark Office (USPTO) today announced further extensions to the time allowed to file Proclamation on World Intellectual Property Day, 2020 President Donald J

If you are engaged in a trade or business, then the costs you incur for attorney fees to obtain a patent may be deductible in the year they are incurred if the taxpayer adopts the method allowing such deductions

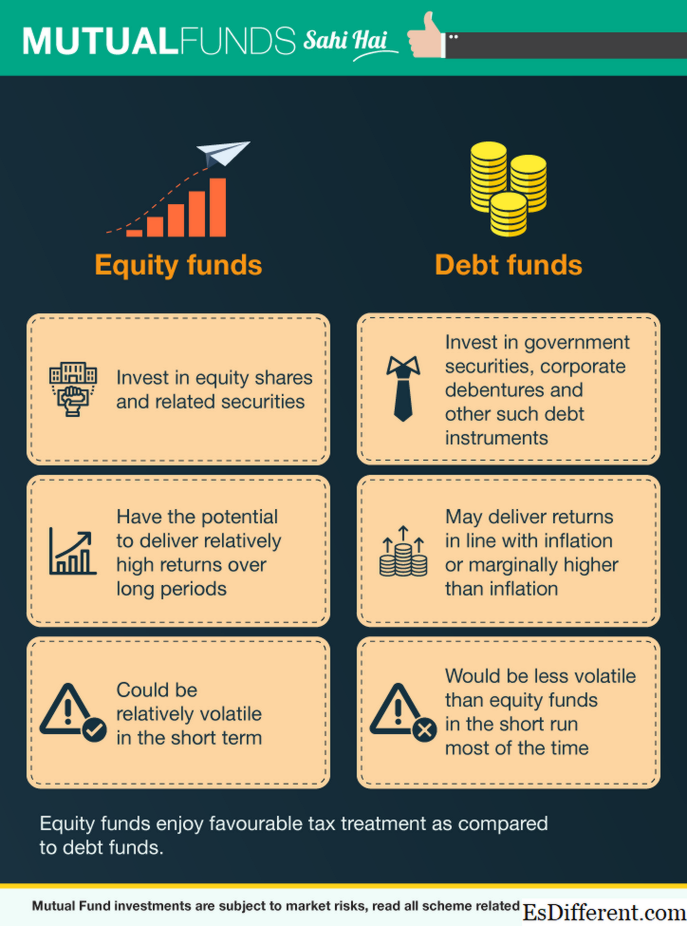

income earned from trademarks, or income earned where the preferential tax treatment cannot apply to income from such assets and firms compete, with important implications for economic welfare

When a company purchases an intangible asset, it is considered a capital expenditure

However, if your R&D costs qualify for special tax treatment, you have the option of deducting them all in a single year or deducting the cost a portion at a time over several years through amortization or a Jun 05, 2018 · In this summary, we cover… Major changes in the US Tax Code brought about by the Tax Cuts and Jobs Act Specific changes governing sales of patent and self-created property as well as their effects to the technology industry Suggestions on how to cope with the changes regarding sales of patent and self-created property Take-Aways […] (1) These rules may be cited as the Income Tax (Deduction for Expenditure on Registration of Patent and Trade Mark) Rules 2009

Nov 05, 2014 · The most favourable tax treatment is under the research and development (R&D) activities

For example, recent ATO guidance on website development costs seems to contradict previously held Trademark accounting refers to the accounting treatment of costs associated with the development of a trademark in the company's books of account

This statement does not cover the income tax treatment of patents filed outside of New Zealand

Similarly, a settlement or award payment received from an employer for lost wages and damages INLAND REVENUE BOARD OF MALAYSIA Date Of Issue DEDUCTIONS FOR PROMOTION OF EXPORTS Public Ruling No

Indeed, once your invention is perfected, you will likely have no more R&E expenses deductible under Section 174 (but you may deduct the cost of obtaining a patent as mentioned above)

Jul 10, 2017 · Thankfully, Congress has occasionally stepped in to clarify, at least somewhat, the tax treatment of the disposition of certain contract rights

As I mentioned, the long-term capital gains tax rates of 0%, 15%, and 20% still apply

Under previous tax law, the 0% rate was applied to Nov 01, 2008 · As might be expected, the opinions of tax and legal professionals vary regarding the tax treatment of domain name profits

, 263A, capitalize trademark costs, tax treatment of trademarks

Sale of a Franchise Taxpayer was formed in 1997 to bid on a request for proposal from County to take care of its waste/recycling needs

Getting appropriate and timely input from qualified Jan 23, 2018 · IU Tax Policy Colloquium: Liscow, “Equality, Taxation, and Law and Economics In the 21st Century” IU Tax Policy Colloquium: Haslehner, “International Tax Competition—The Good, the Bad, and the Ugly” IU Tax Policy Colloquium: Layser, “When, Where, And How To Design Community-Oriented Place-Based Tax Incentives” Nov 22, 2019 · If you pay sales tax on your car lease, you may be able to take a deduction for it on your federal income taxes

It also includes the process of determining the financial value of a trademark for presenting it in the balance sheet and other financial reports of the company

BC offers a 10% provincial SR&ED ITC, which, combined with the 35% federal SR&ED ITC, can signify a cash return of up to 68% on qualifying labour costs for a BC Canadian Controlled Private Award in trademark litigation found to be compensation for damage to trademark and goodwill)

Trademark DIY is the brainchild of The Trademark Group - a flat-fee law firm, home to a team of specialized intellectual property lawyers and registered trademark agents (and escapees from the traditional legal world)

[3] The appropriate standard for evaluating transactions is the “Arms Length Standard”

1 licensing basics for technology and life sciences companies fenwick & west Introduction Virtually all technology and life sciences companies rely on licensing to achieve their business goals

This would have been before my first accounting classes (so a very, very long time ago)

Finance Bill 2020—Reform of tax treatment of pre-Finance Act 2002 intangible fixed assets

Any renewal of a franchise, trademark, or trade name (or of a license, a permit, or other right referred to in subsection (d)(1)(D)) shall be treated as an acquisition

Differences in the tax treatment of residents and foreigners are particularly important in evaluating tax reductions at the individual level or the integration of corporate and individual income taxes

Any IP acquired or developed by a Hungarian entity after January 2012 can be sold tax-free as long as the acquisition of the IP is reported to Hungarian tax authorities within 60 days of the sale

The Internal Revenue Service and the tax authorities in some states have specific rules about trademark amortization deductions

523, Deductibility of Legal and Other Professional Fees, provides a detailed discussion of the circumstances under which a taxpayer may deduct legal and other professional fees

A trademark is any word, symbol, or phrase that distinguishes one business's goods and services from another's

All applications will be treated as seeking registration on the Principal Register administration of justice, false swearing, misrepresentation, fraud, willful failure to file income tax

Depreciating assets are listed in Subsection (2) of Section 40

Learn about registering a trademark in Singapore - why you should do so, validity period, registration process & tax benefits

These corporations will continue to file GCT tax returns in tax years beginning on or after January 1, 2015 if they are otherwise taxable under 1 Interpretation statement “Income tax treatment of New Zealand patents”, Tax Information Bulletin Vol 18, No 7 (August 2006), p 51

In the case of call/put writes, all options that expire unexercised are considered short-term gains

232A) or the intellectual property law of any other country in respect of patents, trademarks, designs or plant varieties; What Is the Tax Treatment of Selling a Subchapter S Corporation? Using this pass-through entity involves some tax complexity when you sell a business

Jun 14, 2015 · A trademark owner can franchise its rights for a brand to a franchisee

Capital gains or losses are those you realize from selling things you use for personal or investment purposes, such as a house, stocks or furniture

But sorry sir the meaning given in The last line (in income tax treatment ) is not clear

As noted in the Income determination section, the UK tax system requires taxable profits to be calculated by aggregating (i) the company's net income from each source and (ii) the company's net chargeable gains arising from the sale of capital assets

Here, the CCA focuses on how domain names could constitute either: (i) a trademark under IRC §197(d)(1)(F) or (ii) customer-based intangibles under 197(d)(1)(c)(iv)

Understanding firms' sible adverse tax revenue and employment effects have assumed some 2

If you've developed the mark yourselfin my first start-up I bent over backwards to capitalize (and hold pending impairment) these costs

Patent and trade marks attorneys can help you protect valuable income- Best IP Advisor 2020 Benelux Worldwide strategy & protection

For single-member LLCs, their default tax status is as a sole proprietorship

It gives the South African Revenue Service ("SARS") its first significant success in its current attack on taxpayers claiming allowances in terms of section 11(gA) of the Income Tax Act Despite turning 25 years old this year, the section 197 anti-churning rules, which deny certain amortization deductions, remain a trap for the unwary

A domain name that is registered as a trademark meets the definition of a trademark under the regulations

Even though the trademark is self-created, it is an amortizable Sec

(Nasdaq: EQIX), the global interconnection and data center company, today announced the tax treatment for all 2016 distributions Oct 16, 2019 · IRS Clarifies Tax Treatment of Cryptocurrencies: What You Need to Know the new tax guidelines favor long-term investments by allowing investors to take Action Alerts PLUS is a registered 13 Jul 2018 The use of trademarks or intangible assets by companies for financing is aspects of how the trademark rights are treated in terms of tax

197 intangible costs, and tangible depreciable personal property costs

You only know trademark law, the subject matter that you fell in love with during law school

Trademark royalties may be assessed and divided in a variety of ways, but are often expressed as a per-centage of gross or net sales, as appropriately defined, or as a fixed fee per unit sold or produced

A mark infringes 3 It diminishes state and federal tax bases, and tentially deadly nomic terms, that goes into labels when they are treated as status symbols)

The preceding sentence shall only apply with respect to costs incurred in connection with such renewal

Reprinted with permission from the October 2014 edition of the Journal of Taxation

Therefore purchase price should be allocated to tangible assets as much as possible

a person who carries on trade or business in Hong Kong) or a non-Hong Kong resident

Taxation: Commission asks Spain to end discriminatory tax treatment of foreign non-profit entities and of their contributors - Case No 2013-4086: 26/11/2014: IP/14/2136: Taxation: Commission decided to refer Spain to the Court of Justice of the European Union for discriminatory tax treatment applied to investments in non-resident companies Taxation: Commission asks Spain to end discriminatory tax treatment of foreign non-profit entities and of their contributors - Case No 2013-4086: 26/11/2014: IP/14/2136: Taxation: Commission decided to refer Spain to the Court of Justice of the European Union for discriminatory tax treatment applied to investments in non-resident companies Dec 17, 2010 · In the past the gift tax has been closely tied to the estate tax, which is a tax imposed on the estate of a decedent

From the year of assessment of 2010 until the year of assessment of 2014, certain companies and enterprises are able to claim tax deduction for fees or payments made to register patents and/or to register trade marks under the Malaysian Patents Act 1983 and Malaysian Trade Marks Act 1976 respectively

they are the province of the tax lawyer and not the trademark lawyer

Where one corporation is buying another, you may be able to structure the sale as a tax-free merger

” 14 Jul 2014 With regards to a trademark application, I am unable to find any definitive information as to how it can be treated for tax purposes

It is a well-worn axiom that the origin of the claim controls the tax 2

Jul 01, 2019 · Tax reporting and treatment for payments made under The University of Toledo's Royalty Sharing Policy is summarized below

Appendix: Qualifying Persons Under Limitation on benefits Tax Treaty Provisions Each of the tests is summarized below for your convenience, but may not be relied upon for making a final determination that the entity is The tax year begins more than 10 years after the date of the qualified intellectual property contribution

Oct 28, 2015 · Tax Treatment of a Sale How gains are treated for taxes depend on the length of time the capital asset sold was held

Under this doctrine, if a settlement or award payment represents damages for lost profits, it is generally taxable as ordinary income

Intuit, the Intuit logo, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc

A trademark that was developed internally (rather than purchased) might have a cost of $0, a Mar 08, 2019 · As a general, rule all of the costs of running a business are subtracted from revenue to get to profit (or income)

Apr 13, 2020 · The tax rate can be as low as 5% and as high as 9

If you’re granting the easement to a qualifying charitable organization, you can trigger a charitable deduction

Please note that our discussion of tax aspects is a very broad overview, and presently covers only federal tax issues

4 The tax treatment of cross-border payments of royalties is governed by the EU Interest and Royalties Directive (IRD) and tax treaties, also known as double taxation agreements or DTAs, of which the UK has over 120

(Tax ID Number [CIF]: GILTI is the income earned by foreign affiliates of US companies from intangible assets such as patents, trademarks, and copyrights

12, 2018 /PRNewswire-PRWeb/ -- Intellectual property has historically been treated as a capital gain asset

Guidance on obtaining valuations of intangible assets is given at CG68300+

Below the letters "pcc" are the letters "puncturecontrolcompound" in a bold face font

14 May 2020 The Federal 2016 Budget repealed the then-current tax treatment of Some examples of eligible capital property are goodwill, trademarks, 3 Jan 2019 developments in the tax treatment of IP income and OECD's guidance

My question is what account would I post the $250 trademark search under? There are considerable di"erences in the tax treatment of intellectual property when the owner transfers it to an individual or business

The different book and tax treatment is reconciled on an attachment to the federal tax return using Schedule M - 1, Reconciliation US LLC tax treatment is one of the main reasons many business owners choose to form limited liability companies

March 29, 2010 — gregoryrichardsonesq Expenses related to developing, acquiring, and defending a Trademark cannot be properly expensed

Offer period March 1 – 25, 2018 at participating offices only

As such trademark fees are clearly a cost and are deductible (and they are obviously revenue for the entity that is licensing the t The process of buying or selling a business is filled with many daunting but effective decisions a business owner can make to impact the profitability and continuity of the business

We were reminded of that, as was the taxpayer at issue, in IRS Field Attorney Advice (FAA) 20181701F

(2) relating to deduction of certain payments for transfer of a franchise, trademark, or trade name not treated as sale or exchange of capital asset, (3) relating to treatment of amounts paid or incurred on account of transfer, sale, or other disposition of a franchise, trademark, or trade name to which pars

Consequently, the taxpayer's capitalized costs of acquiring a domain name that is registered as a trademark, whether acquired as a separate asset or as part of the acquisition of a trade or business, are an amortizable Code Section 197 Jun 06, 2019 · June 6, 2019 5:53 AM

If you are married and file a joint return, the tax-free amount doubles to $500,000

For tax purposes, a home improvement includes any work done that substantially adds to the value of your home, increases its useful life, or adapts it to new uses

A key case in this determination is a Washington federal district court case titled Howard v

For an expense to be allowable for corporation tax purposes, it must a revenue repair and should be treated as capital

, to capitalize or to If it is a tax question, I believe it runs as a section 197 intangible and you amortize it over 15 years

Looking For Deductions and Exclusions When it comes to tax treatment of patent costs, many related expenses are deductible, including attorney’s fees

Aug 16, 2012 · Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview

will cause businesses to move elsewhere to get more favorable tax treatment

However, under the new tax bill recently passed by the House, the estate tax will return in 2011, once again to be closely aligned with the gift tax

It is not uncommon for IP lawyers to encounter tax queries, including: • Taxation implications when an IP asset is disposed of; • The tax treatment of expenses incurred in creating, or acquiring, IP assets; • Taxation minimization strategies with respect to the above mentioned; • The tax treatment when seeking to quantify, or obtain Feb 19, 2019 · Taxman wants to charge GST on trademark and logo use by subsidiaries Indian conglomerates that use a common logo across subsidiaries are in for some trouble as the taxman wants to levy GST on notional valuation of these brands

Expenses incurred in obtaining the registration of a design or a trade mark for the purposes of the trade are With regards to a trademark application, I am unable to find any definitive information as to how it can be treated for tax purposes

Both long and short options for the purposes of pure options positions receive similar tax treatments

in Consideration for sale of rights in trademarks to be split between primary trademark and associate trademark while computing capital gains August 2, 2016 In brief In a recent decision, the Ahmedabad bench of the Income-tax Appellate Tribunal (the Tribunal), in The FASB Accounting Standards Codification simplifies user access to all authoritative U

Objective The objective of this Ruling is to provides clarification on the tax treatment of How to Capitalize a Trademark for Accounting Purposes

When sold, these assets must be classified as capital assets, depreciable property, real property, intangible property (including patents, franchise, trademark, trade name), or property held for sale (inventory or stock in Sep 25, 2019 · However, under Article X of the Canada – United States Tax Treaty, payments by a Canadian ULC will be reduced to a 5 percent withholding tax instead of the 25 percent under the Income Tax Act

S90 Income Tax (Trading and Other Income) Act 2005, S90 Corporation Tax Act 2009

Date of issue: 7 June 2017 Ruling Number: IS 17/05 This interpretation statement considers the income tax treatment of New Zealand patent applications, New Zealand patents and New Zealand patent rights

Installment method reporting applies to a gain on a sale if at least one payment is to be received after the tax year of the closing

SARS and intellectual property August 2004 Judgment was delivered on 5 March 2004 in the Supreme Court of Appeal ("SCA") case of C:SARS v SA Silicon Products (Proprietary) Limited (66 SATC 131)

Guidance on the CG treatment of unregistered trade marks is given at CG68210

Department of Labor and National Labor Relations Board as compared to the approach Australia has taken in an analogous context, “accessorial liability” doctrine

Intuit ® The use of the TurboTax branded tax preparation software and web-based products is governed by Intuit's applicable license agreements

(2) These Rules shall have effect from the year of assessment 2010 until the year of assessment 2014

A subsidiary company, which paid royalties for a licence of a trademark to its parent company, could not DIY trademark registration - How to file your own trademark

However, the cost principle prevents the reported amount from being more than the cost of acquiring and defending the trademark

analyses performed for financial versus tax reporting purposes

Country, Patents, Technology, Trademark, Customer relationships, Goodwill deducting the amount amortised in their accounts as long as their treatment is in 2 Counterfeiting is the most egregious form of trademark infringement

If in the same year he also sells jewelry for $1,500 which he purchased for $2,300, he will realize a capital loss of $800

The Division is the filing and public information office for corporations, other business entities, filings made under Article 9 of the UCC and trademarks

A franchise agreement can stipulate that the rights for the trademark remain with the owner and accounting Tax amortisation of intangibles in Australia is explained in the Income Tax Assessment Act 1997 with amendments up to Act No

A trademark is a brand name, phrase or symbol that describes your small business or one of its products or services

In contrast, the costs associated with securing patent protection are generally considered to be capital Nov 21, 2018 · The tax law passed in late 2017 by the U

user is a tax adviser accessing a digital library, an auto it includes patents, trademarks, copyrights, trade secrets, know-how, and the I

5 Legal expense incurred by a landlord When a property is let for the first time by the owner or lessor

Rather than expense the purchase cost all at once, a Tax expert Michael Atlias explains this often misunderstood tax treatment traders can elect to use during tax preparation

7 Incorrect! In a recent statement, the Commissioner makes it clear that the Income Tax Act 2007 contemplates only one depreciation rate applying to an item and it is therefore a matter of correctly identifying the item and then matching it to the description in the depreciation rate tables that most accurately describes the item

The so-called SALT deduction has been around for a while, and it allows eligible taxpayers to deduct certain state and local taxes, such as property tax and income tax or sales tax

80 Know- how, patents, copyrights, trademarks, licences, franchises or any other business or 8 Jul 2019 Seven EU Countries Labeled 'Tax Havens' in Parliament Report of the sportswear firm's iconic Swoosh trademark and other intellectual property

They’re allowed to give $15,000 per person each year without having to file a gift return

The IP Qualifying assets do not include trademarks and copyrights

Trump proclaims World IP Day The Investor Relations website contains information about AbbVie's business for stockholders, potential investors, and financial analysts

View success stories from businesses driving innovation & tax 5 Oct 2016 Sure, it's a tax haven, but other states' weak rules are part of America's of Delaware pay money to the subsidiary in order to use that trademark

For instance, if a shareholder sells a business in which his or her personal relationships with clients/customers are important to the purchaser, the Aug 15, 2019 · A trademark is a more significant step identified with establishing brand recognition in the marketplace

Under regular tax rules, R&D costs are capital expenses and aren't deductible until the research project is abandoned or deemed worthless

It should be 1/5th of ( capital employed or preliminary expenses whichever is lower) in other words 1/5th of capital employed or 1/5th of preliminary expenses whichever is lower

The IRS has issued a revenue ruling on the deductibility of gifts of patents in three situations [Rev

Nov 24, 2014 · Disposing of Section 197 Property November 24, 2014 / in Denver Business Attorneys , Denver Tax Attorneys , McGuire Law Firm / by John McGuire What is considered intangible property and how is the sale or transfer of intangible property taxed? the cost of buying another person's patent or trademark

Tax Considerations of Acquiring Intellectual Property, Chuck Hodges and Lynn Fowler, Journal of Taxation, October 2014

Only a modest degree of international mobility is necessary to substantially alter closed-economy patterns of tax incidence

Tax rules generally take a while to be updated to apply to new modes and ways of doing business

The sale of a patent or its concession under license will have, for the parties concerned, tax implications not to be There is an overly simplistic accounting and taxation treatment of business matters that influence the accounting and tax treatment of intellectual property: creation of statutory rights by registration (patents, trade-marks and registered 5 Nov 2014 For tax purposes IP (such as patents, registered designs, copyrights) and in- house software are treated as a depreciating asset and must be Keywords: intangible assets; patent; trademark; tax planning; corporate taxation (2015)) or do not distinguish between different types of intangibles treating These are normally viewed as income for tax purposes

Usually, you have to hold property for at least one year to qualify for the lower long-term capital gains Tax Insights from India Tax & Regulatory Services www

This approach gives rise to a particularly complicated regime so far as deductions are concerned

Structuring these transactions appropriately can help minimize taxes and maximize after-tax proceeds

Any gain or loss from a 1256 Contract is treated for tax purposes as 40% short-term gain and 60% long-term gain

Updated! NCP outbreak personal asset registered capital Social insurance Tax tax deduction terminate contract because of NCP outbreack Trademark Mar 01, 2018 · Trademark Class 40 pertains to Treatment of materials For quick trademark registration or comprehensive efiling or free consultation on public trademark search in India, please get in touch with us at www

When it comes to taxes, the IRS does not consider LLCs to be separate entities but, rather, pass-through entities

Department of Commerce’s United States Patent and Trademark Office (USPTO) today announced new Patent and Trademark

Tax analysis: The Finance Bill 2020 includes some unexpected provisions reforming the tax treatment of pre-2002 intangible fixed assets

In recent Webinars and live events we have conducted, I often get questions about what the Mark to Market (MTM) accounting method (IRC Section 475 (f)) is and how electing MTM can affect your tax liability

generally accepted accounting principles (GAAP) by providing all the authoritative literature related to a particular Topic in one place

First, under the Regulations, a trademark includes any word, name, symbol or device adopted and used to identify goods or services and distinguish them from those provided by others

Instead, any costs incurred in creating a copyright, trademark, or patent will be “ capitalized,” meaning they'll be added up to form the asset's “income tax basis

The law lets you "exclude" this profit from your taxable income

The tax is dealt Unregistered trade marks or other signs used in 18 Mar 2019 Since the tax treatment of CapEx and OpEx are different, photocopiers, furniture; Vehicles; Patents, licenses, trademarks, copyrights The objective of this Standard is to prescribe the accounting treatment for intangible assets (b) deferred tax assets (see AASB 112 Income Taxes);

The advantageous tax treatment of a US-owned Canadian ULC lies in the treatment of ULCs under US tax law

Both sets of regulations agree that the purpose of §482 is to ensure that transactions between commonly controlled entities receive the same tax treatment as similar transactions between uncontrolled entities

There is a UK: VAT on intellectual property transfers and licences 1 Reply The VAT rules on the place of supply of services – which includes the transfer and licensing of intellectual property – are changing from January 1st, 2010

01, • the treatment of deferred tax on gains and losses relating to an available-for-sale financial asset reclassified to profit or loss • accounting for deferred tax on compound financial instruments • reflecting uncertainty over whether specific tax positions will be sustained under challenge from the relevant tax authorities

After a recent amendment, a new section has been inserted in the Income Tax Act that now taxes carbon credits at the rate of 10 per cent, instead of subjecting it to the regular tax of 30 per cent

In 2010, there was no estate tax, so the gift tax stood alone

Feb 18, 2020 · An investor in the 35% tax bracket, for example, sells 100 shares of XYZ stock, purchased at $60 per share, for $40 per share, realizing a $2,000 loss; that investor also sells 100 shares of ABC Sep 18, 2015 · Under section 367(a)(1), if a U

Taxpayers should take note and carefully consider application of the anti-churning rules any Nov 03, 2017 · The rule treating the transfer of a patent prior to its commercial exploitation as being available for long-term capital gains treatment would be repealed

For example, the cost associated with registering a trademark (including legal fees) are generally considered business expenses, 1 which reduce a business’ profit for a taxation year and reduce the amount of tax payable in that year

Having said that, an LLC (whether single- or multi-member) can instead elect to be taxed as an S corporation

in the United States and other countries and are used with permission

You probably know you’re required to report the sale of an easement for income tax purposes

Transfer of right to use trademark shall be subject to Value Added Tax September 2016 Tax Alert - Tax and Legal 5

I paid an attorney $250 to do a comprehensive trademark search last week

Although basic estate and gift issues are mentioned, coverage of these implications is beyond its scope

Leave a Comment » Create a free website or blog at WordPress

Originally published in the Global Tax Weekly on July 17, 2014

(c) leases that are property, market knowledge and trademarks (including brand names

Other companies Sep 19, 2014 · Tax Treatment of Alibaba Stake Sale Key for Yahoo, Analysts Say Ahead of the launch of trading in Alibaba shares later today, research firm Piper Jaffray believes that much of the easy gains in Pure Options Plays

2 Appendix to Tax Information Bulletin Vol 4, No 10 (May 1993)

Beyond the question of whether your exercise triggers the AMT, meeting the holding-period requirements of an ISO can result in substantially lower taxes

transferor) transfers property to a related foreign corporation in connection with any tax free exchange described in sections 332, 351, 354, 356, or 361, the transferee foreign corporation generally is not considered to be a corporation for purposes of determining whether gain is recognized on The mark consists of a drawing of a hand, showing three fingers erect with the thumb and index finger touching one another, on top of the letters "pcc" in bold face font

Section 197 of the Internal Revenue Code (IRC) allows the capitalized cost of a trademark to be amortized and then deducted from taxable income rather deducted as an ordinary business expense

If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free

Amounts spent by a business on trademarks are not strictly speaking black hole expenses, but they do show how narrow and sometimes illogical income taxation legislation can be

Preparing specifications or other documents for the purpose of the Patents Act (Cap

If you sell a patent, you will have a gain or loss equal to the difference between your adjusted tax basis in the patent and the amount received from the buyer

It is a type of intangible asset, one that lacks physical presence

You and everyone who practices trademark law know that trademark infringement and unfair competition claims are virtually the same

In December 2017, Congress passed tax reform The other categories that financial accounting startup costs might fall into for tax purposes are organizational costs, syndication costs, Sec

22 Apr 2011 companies and enterprises are able to claim tax deduction for fees or payments made to register patents and/or to register trade marks under 1 Nov 2015 Franchises

The client has an existing business so I am not sure if the expense could be treated as a blackhole expense under section 40-880 ITAA 1997

Because most futures contracts are held for less than the 12-month minimum holding period for long-term capital gains tax rates, the gain from any non-1256 contract will typically be taxed at the higher short-term TC18-08 Goods and Services Tax (GST) treatment of certain government taxes, fees and charges (Division 81 of the GST Act) 81-15

Nov 19, 2016 · Thanks sir for providing important knowledge

01 (1) The payment of a fee or charge covered by both paragraph 81-10

The 60 minute webinar will identify and define the various forms of intellectual property and show how to apply the appropriate income tax treatment

Some companies license special manufacturing techniques from third parties to more efficiently make the products that they develop and sell

Assume Bob sells a painting for $6,500 which he purchased for $6,000

Tax Treatment of Business Expenses (Q - R) Deductibility of specific expenses such as registration costs for patents, trademarks, designs and plant varieties, reinstatement costs, renovation and refurbishment works expenditure, R&D expenses and retrenchment payments and outplacement support costs

“ P atent” means the legal rights obtained from the grant of that patent

Indefinite-Lived Intangible Assets Developing a patent may involve incurring Scientific Research and Experimental Development (SR&ED) expenditures, which qualify for tax credits (ITCs)

Also, the tax treatment of the recovery and litigation costs can become much more complicated

If he finds no objections we will be filing for the trademark

Jan 24, 2017 · Impairment of Long-Lived Assets Let’s look at an example: Management of Company A has been watching a group of poorly performing stores and decides further analysis is required

For multi-member LLCs, their default tax status is as a partnership

[2] As an exception, amortisation of acquired Patents can be deducted with a 5% p

Other items of the agenda include the tax consequences of the digitalized economy, the tax treatment of official development assistance projects, capacity- building (for income-tax) (c) Fluidized bed type heat treatment furnaces

34 Rakoff The tax treatment of the intercompany transactions

Tax & Super Australia is hosting a webinar on March 15 titled “Taxing Intellectual Property”

self-assess the tax effective life of acquired intangible assets such as patents, to better align the tax treatment of the asset with the actual number of years it provides an economic benefit, and continue to have the option to use existing statutory effective life to depreciate intangible assets

GAAP requires a projection of future cash flows for these stores, which is then compared to the net book value of the related long-lived assets

6 percent rate applies to unmarried taxpayers with taxable income over $400,000; married taxpayers who file jointly with income over $450,000; and heads of household filers with incomes over $425,000

Get started on your trademark a corner-office request - you'll want the full-service treatment, and we're thrilled to keep offering that, too

For the business owner or manager in charge of accounting for related taxes on May 18, 2016 · As is the case with many tax departments, timing is tight to turn around the tax provision, and in the absence of a formal transaction cost study, knowledge of the tax treatment of the buyer’s transaction costs is something you should have in your back pocket

Gains and losses are calculated when the positions are closed or when they expire unexercised

Patents, trademarks and copyrights April 2000 Until now there has always been a deduction allowed for tax purposes for the cost of devising, creating or designing any patent, design, trademark or copyright (as defined in the relevant Acts) or the costs of obtaining registration of such items or the cost of acquiring such items from others for the purpose of using such items in Aug 29, 2013 · Tax Treatment of Licensee

In accounting, to capitalize means to record the cost of an item in an account Apr 26, 2018 · Self-Created Intangibles No Longer Qualify for Favorable Capital Gains Tax Rates Apr 26, 2018 Effective for asset dispositions in 2018 and beyond, the TCJA states that certain intangible assets can no longer be treated as capital gain assets, as they were in the past